199 $ 65 $

Chat with us or contact us via email shoppycourses@gmail.com if you want to pay with PayPal or Credit Card

GET 10% OFF

Sale Page: https://breakingintowallstreet.com/venture-capital-modeling/

👉 Check All Exclusive Courses HERE

Check All Exclusive Courses HERE  👈

👈

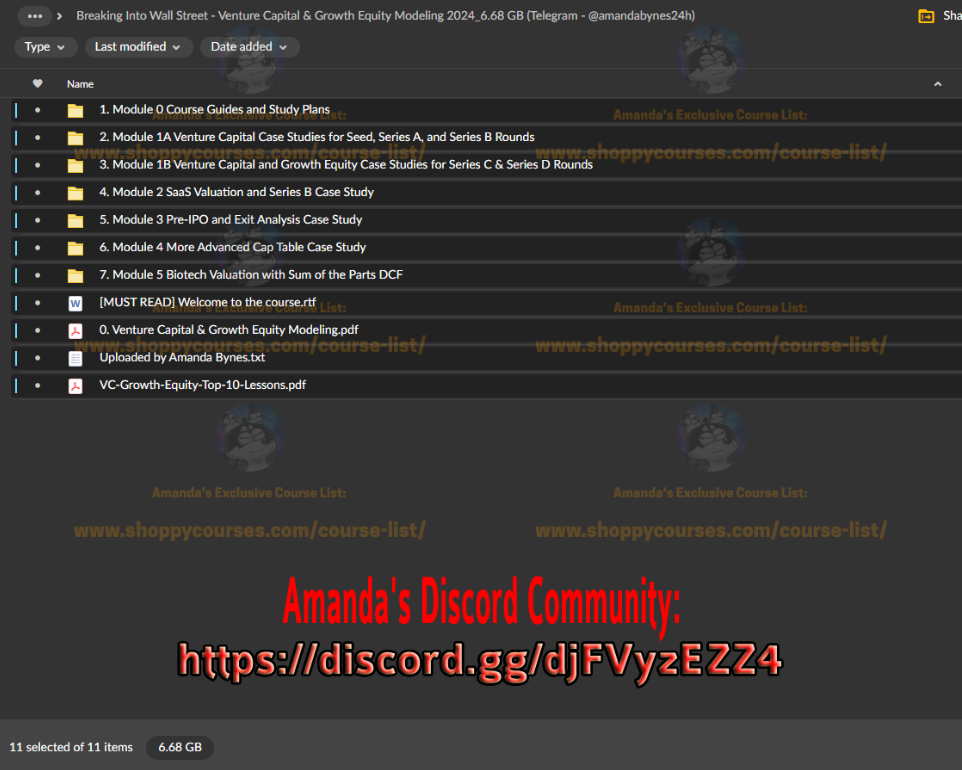

Proof Download

Breaking Into Wall Street – Venture Capital and Growth Equity Modeling 2024

How to Master Cap Tables, Startup Valuation, and Exit Modeling – So You Can Ace Your

Venture Capital and Growth Equity Interviews and Advance to the Top

Evaluate companies and deals like a pro

You’ll understand cap tables, startup/growth valuations, and exits

Master financial modeling

You’ll build forecasts and analyze metrics for tech and biotech startups

Complete 9 case studies

You’ll learn the numbers and how to make investment recommendations

What’s inside Venture Capital and Growth Equity Modeling 2024?

The course is divided into 5 short case studies (think: weekend crash-course plan)

and 4 longer case studies (think: on-the-job mastery).

Through these case studies, you’ll learn to:

Analyze a startup’s market and customers, including cohort analysis for Software

as a Service (SaaS) companies.

Build capitalization tables (cap tables) for Seed and Series A – C funding rounds.

Model the impact of liquidation preferences, employee option pools, participating preferred, and more.

Discern if a startup’s financial forecasts are credible or closer to a fantasy novel.

Understand how “down rounds” and terms like anti-dilution and pay-to-play

affect exits and investment results.

Value tech and biotech companies based on multiples and the DCF, with adjustments

for “key person” risk, illiquidity, and more.

Explain how biotech and tech startups differ and how that translates into

valuation, cap table, and exit differences.

Evaluate different deal structures, such as SAFE Notes vs. priced equity rounds,

and the trade-offs between valuations and downside protection for the investors.

Value biotech startups with a Sum-of-the-Parts DCF that analyzes each drug’s potential separately.

Build advanced cap tables with support for features such as convertible notes, venture debt, pro-rata equity,

anti-dilution provisions, participating preferred, and pari passu vs. ranked seniority.

Make investment recommendations based on everything above, factoring the qualitative and quantitative factors.

If you want to answer interview questions and case studies with ease and leap up the ladder

once you start working, this is the course for you.

Be the first to review “Breaking Into Wall Street – Venture Capital and Growth Equity Modeling 2024” Cancel reply

Related products

Business

Business

Business

Business

Business

Reviews

There are no reviews yet.