298 $ 50 $

Chat with us or contact us via email shoppycourses@gmail.com if you want to pay with PayPal or Credit Card

GET 10% OFF

Trading Alphas – Mining, Optimisation, and System Design

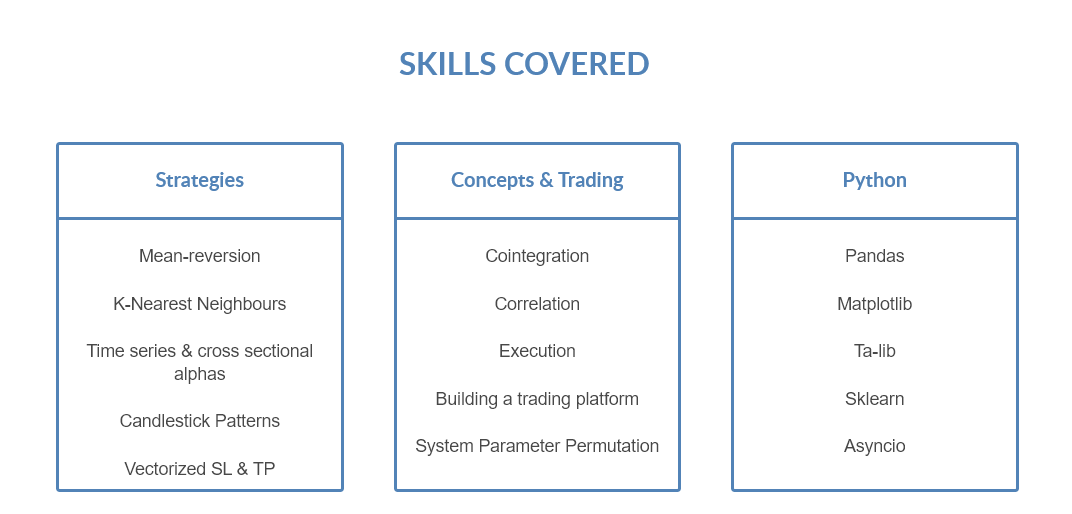

Why should you choose micro alpha models over other trading strategies such as traditional factor models, risk-parity, or trend following? In short, these models, if built well, can provide better performance, stability, and risk management than other trading systems. In this course, you will learn where micro-alphas reside and how to write the most efficient codes to quickly analyse, backtest, optimise and go live with your trading strategy in the least amount of time possible.

LIVE TRADING

- Backtesting, adding stop-loss and profit-take using vectorised approach

- Mining micro-alphas using trends, mean-reversion, correlation across assets, and cointegration

- Metrics for analysing strategy which include total profit, sharpe ratio, sortino ratio, profit factor, drawdown, and profit per trade

- Parameter optimisation using machine learning techniques such as clustering

- Building a trading system from scratch

- Explain software architecture, logging, storage, hardware, testing and version control

- Brief study on execution models, implement parallel computing and describe different levels of logging

About your mentor – Dr. Thomas Starke

Dr Thomas Starke is the CEO of the financial consultancy firm AAAQuants. Witha remarkable career spanning working with Boronia Capital, Vivienne Court Trading and Rolls-Royce, he has Worked on the development of high-frequency stat-arb strategies for index futures and Al-based sentiment strategy. As an academic, he was a senior research fellow and lecturer at Oxford University. A tech aficionado, he takes a keen interest in new technologies such as Al, quantum computing and blockchain. He holds a PhD in Physics from Nottingham University (UK).

Sale Page: https://daniel-marcelo-s-school.teachable.com/p/amazon-shineon

Be the first to review “Trading Alphas – Mining, Optimisation, and System Design” Cancel reply

Related products

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Uncategorized

Reviews

There are no reviews yet.